The Rounded Bottom pattern, and how to use it

The rounded bottom pattern, also known as a saucer bottom pattern, is a bullish chart pattern that is formed by a rounded, “U” shaped pattern. This pattern is created when the price of an asset falls to a support level, makes a series of higher lows, and then eventually starts to rise. The rounded bottom pattern is typically seen as a bullish sign and indicates that the asset’s price is likely to reverse its downward trend and start rising.

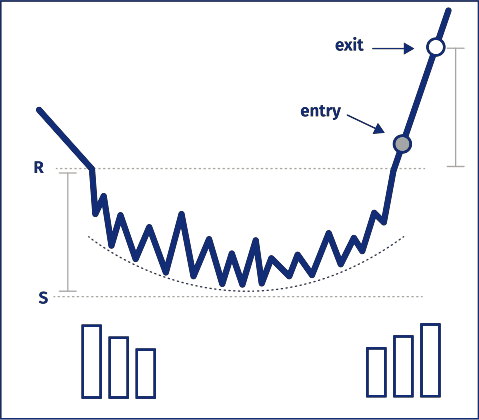

To form a rounded bottom pattern, the asset’s price will typically fall to a support level, make a series of higher lows, and then eventually start to rise. The pattern gets its name because the shape of the price action resembles a rounded, “U” shape. The pattern is typically completed when the price breaks through the resistance level, at which point it is likely to continue rising as traders enter into long positions.

One of the key characteristics of the rounded bottom pattern is that the trading volume tends to increase as the pattern progresses. This is because the price is making a significant move and there is more activity from traders. However, once the price does break through the resistance level, trading volume may decrease as the price starts to rise and traders become less active.

In order to trade the rounded bottom pattern, traders should look for the following characteristics:

- A rounded, “U” shaped pattern: This is the key feature of the rounded bottom pattern, as the asset’s price falls to a support level, makes a series of higher lows, and then eventually starts to rise.

- Increasing trading volume: As the pattern progresses and the price approaches the resistance level, trading volume should increase.

- A breakout: Once the price breaks through the resistance level, traders should enter into long positions and expect the price to continue rising.

It is important to note that the rounded bottom pattern is a bullish pattern, but it is not a guarantee that the asset’s price will rise. As with any trading strategy, it is important to use risk management techniques and to always be aware of the potential for losses.

One way to trade the rounded bottom pattern is to set a buy order just above the resistance level, as this is where the price is likely to break through and start rising. Traders can also set a stop loss order just below the support level, in case the price does not break through the resistance and instead falls back down.

Another way to trade the rounded bottom pattern is to wait for confirmation that the price has indeed broken through the resistance level before entering into a long position. This can be done by looking for additional bullish signals, such as a bullish crossover on a moving average or a bullish candlestick pattern.

It is important to keep in mind that the rounded bottom pattern can take some time to form, as the price needs to fall to the support level, make a series of higher lows, and then eventually start to rise before breaking through the resistance level. Traders should be patient and wait for the pattern to complete before entering into a trade.